All Categories

Featured

Table of Contents

That generally makes them a more budget friendly option for life insurance coverage. Numerous people get life insurance coverage to help economically safeguard their enjoyed ones in situation of their unforeseen fatality.

Or you may have the alternative to transform your existing term coverage right into a permanent policy that lasts the remainder of your life. Different life insurance policy plans have prospective benefits and disadvantages, so it's crucial to recognize each before you decide to purchase a plan.

As long as you pay the premium, your beneficiaries will certainly receive the survivor benefit if you die while covered. That stated, it is necessary to keep in mind that the majority of policies are contestable for two years which suggests insurance coverage can be rescinded on death, must a misstatement be located in the application. Plans that are not contestable often have actually a graded survivor benefit.

Premiums are usually less than entire life policies. With a level term plan, you can select your protection quantity and the plan size. You're not secured into an agreement for the rest of your life. Throughout your plan, you never have to fret about the premium or fatality benefit amounts transforming.

And you can't squander your policy throughout its term, so you won't receive any economic benefit from your past coverage. As with various other kinds of life insurance policy, the cost of a degree term plan relies on your age, insurance coverage requirements, employment, way of life and health and wellness. Generally, you'll discover a lot more inexpensive protection if you're more youthful, healthier and much less risky to insure.

Affordable What Is Decreasing Term Life Insurance

Considering that degree term premiums stay the same for the period of insurance coverage, you'll recognize exactly just how much you'll pay each time. Level term protection also has some adaptability, permitting you to personalize your policy with added attributes.

You may have to satisfy particular problems and qualifications for your insurance company to enact this biker. There additionally could be an age or time limit on the insurance coverage.

The survivor benefit is generally smaller, and insurance coverage usually lasts until your child turns 18 or 25. This cyclist may be an extra economical method to help ensure your kids are covered as cyclists can typically cover numerous dependents at the same time. When your child ages out of this protection, it might be feasible to convert the cyclist right into a new plan.

The most usual kind of permanent life insurance coverage is whole life insurance coverage, however it has some vital differences compared to level term protection. Below's a basic overview of what to think about when comparing term vs.

High-Quality The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

Whole life insurance lasts for life, while term coverage lasts for a specific period. The premiums for term life insurance coverage are typically lower than whole life protection.

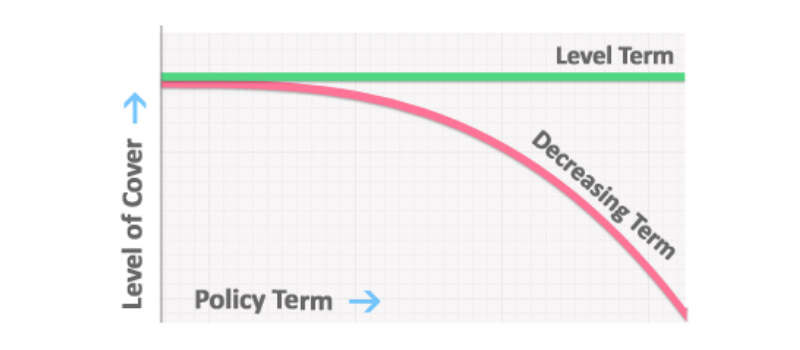

One of the main attributes of level term coverage is that your costs and your fatality advantage do not change. You might have coverage that starts with a death benefit of $10,000, which might cover a mortgage, and after that each year, the fatality benefit will lower by a collection amount or portion.

Because of this, it's frequently a much more budget friendly sort of degree term insurance coverage. You may have life insurance coverage via your employer, but it might not suffice life insurance policy for your demands. The very first step when buying a plan is figuring out exactly how much life insurance you require. Think about aspects such as: Age Family members size and ages Work standing Revenue Financial obligation Lifestyle Expected last expenditures A life insurance policy calculator can help figure out exactly how much you require to start.

After determining on a policy, finish the application. For the underwriting procedure, you may need to give general individual, health, way of life and work information. Your insurance provider will establish if you are insurable and the risk you might provide to them, which is shown in your premium prices. If you're approved, authorize the paperwork and pay your first costs.

Secure Level Term Life Insurance Definition

You might want to upgrade your beneficiary information if you have actually had any substantial life adjustments, such as a marital relationship, birth or separation. Life insurance can sometimes really feel difficult.

No, degree term life insurance policy doesn't have cash worth. Some life insurance coverage plans have an investment function that allows you to construct cash money value gradually. A section of your costs settlements is reserved and can make interest over time, which grows tax-deferred during the life of your protection.

These policies are typically considerably more pricey than term insurance coverage. If you get to completion of your policy and are still alive, the insurance coverage ends. Nevertheless, you have some choices if you still desire some life insurance policy protection. You can: If you're 65 and your protection has run out, for instance, you might intend to acquire a brand-new 10-year degree term life insurance plan.

Reputable Term Life Insurance With Accidental Death Benefit

You may have the ability to transform your term insurance coverage right into a whole life policy that will certainly last for the remainder of your life. Lots of types of degree term policies are exchangeable. That means, at the end of your insurance coverage, you can convert some or all of your plan to whole life protection.

Level term life insurance policy is a plan that lasts a collection term generally between 10 and thirty years and includes a degree fatality advantage and degree premiums that stay the very same for the entire time the policy is in effect. This indicates you'll know precisely just how much your settlements are and when you'll have to make them, allowing you to budget appropriately.

Degree term can be an excellent choice if you're wanting to acquire life insurance protection for the very first time. According to LIMRA's 2023 Insurance Measure Research Study, 30% of all grownups in the United state demand life insurance policy and do not have any type of plan. Degree term life is foreseeable and budget-friendly, that makes it one of the most preferred sorts of life insurance policy.

Latest Posts

Cheap Burial Insurance

Funeral Cover Companies

Burial Insurance Direct