All Categories

Featured

Table of Contents

- – How Does Annual Renewable Term Life Insurance ...

- – Is Level Term Life Insurance Meaning Right for...

- – Short Term Life Insurance Explained

- – What is Life Insurance Level Term? Pros and C...

- – The Essentials: What is Term Life Insurance ...

- – What is Decreasing Term Life Insurance? Pros...

- – What is Term Life Insurance With Accidental ...

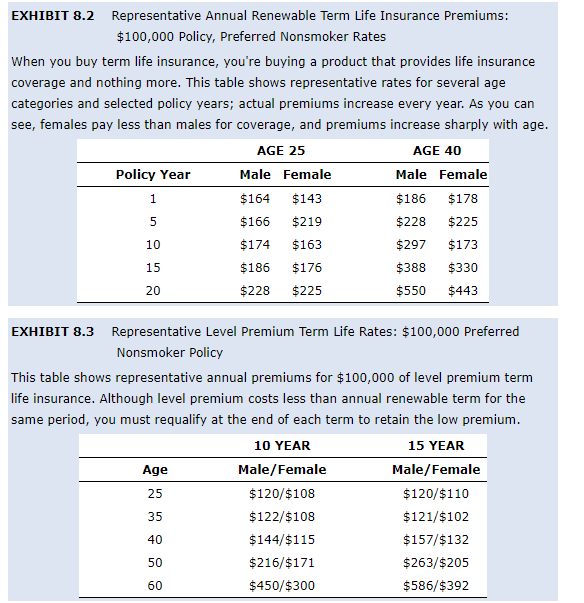

With this kind of degree term insurance plan, you pay the same monthly premium, and your recipient or beneficiaries would certainly obtain the same benefit in the occasion of your fatality, for the entire coverage period of the plan. So exactly how does life insurance policy operate in regards to expense? The cost of level term life insurance policy will depend upon your age and health in addition to the term size and coverage quantity you pick.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Lady$1,000,00030$43.3135 Man$500,00020$20.7235 Female$750,00020$23.1340 Male$600,00015$22.8440 Lady$800,00015$27.72 Price quote based on rates for qualified Haven Simple applicants in excellent health. Regardless of what coverage you pick, what the policy's money value is, or what the lump sum of the death benefit transforms out to be, peace of mind is amongst the most useful advantages connected with purchasing a life insurance coverage plan.

Why would somebody pick a plan with an each year eco-friendly premium? It might be an option to think about for somebody that requires protection only temporarily. A person who is between tasks but desires death advantage protection in place due to the fact that he or she has debt or other financial responsibilities might desire to take into consideration an annually eco-friendly plan or something to hold them over till they begin a new work that uses life insurance policy.

How Does Annual Renewable Term Life Insurance Policy Work?

You can typically restore the policy annually which gives you time to consider your options if you want insurance coverage for longer. That's why it's useful to buy the best quantity and length of protection when you initially get life insurance coverage, so you can have a reduced rate while you're young and healthy and balanced.

If you contribute vital unpaid labor to the house, such as day care, ask on your own what it could set you back to cover that caretaking work if you were no longer there. Make sure you have that coverage in area so that your family members gets the life insurance advantage that they require.

Is Level Term Life Insurance Meaning Right for You?

Does that mean you should constantly select a 30-year term length? In basic, a shorter term policy has a reduced costs rate than a longer plan, so it's clever to pick a term based on the predicted size of your financial responsibilities.

These are all essential factors to bear in mind if you were considering selecting a long-term life insurance policy such as an entire life insurance policy plan. Many life insurance coverage plans give you the choice to add life insurance riders, assume added advantages, to your plan. Some life insurance policy policies come with bikers built-in to the expense of costs, or bikers may be offered at an expense, or have actually charges when exercised.

Short Term Life Insurance Explained

With term life insurance policy, the communication that most individuals have with their life insurance business is a month-to-month costs for 10 to thirty years. You pay your monthly premiums and hope your family members will never have to use it. For the group at Sanctuary Life, that seemed like a missed chance.

Our company believe browsing decisions about life insurance policy, your individual financial resources and overall wellness can be refreshingly simple (Level premium term life insurance policies). Our web content is produced for instructional purposes just. Place Life does not back the business, items, solutions or strategies talked about right here, however we wish they can make your life a little less hard if they are a fit for your circumstance

This material is not meant to give, and must not be depended on for tax, lawful, or financial investment recommendations. Individuals are motivated to seed suggestions from their own tax or legal advice. Learn More Place Term is a Term Life Insurance Policy Plan (DTC and ICC17DTC in certain states, consisting of NC) released by Massachusetts Mutual Life Insurance Firm (MassMutual), Springfield, MA 01111-0001 and used exclusively with Place Life insurance policy Company, LLC.

Best Firm as A++ (Superior; Top classification of 15). The ranking is since Aril 1, 2020 and goes through change. MassMutual has received different rankings from other score firms. Sanctuary Life And Also (And Also) is the advertising name for the And also cyclist, which is included as part of the Sanctuary Term policy and provides access to added solutions and benefits at no expense or at a price cut.

What is Life Insurance Level Term? Pros and Cons

If you depend on someone financially, you may ask yourself if they have a life insurance plan. Learn exactly how to locate out.newsletter-msg-success,.

When you're younger, term life insurance coverage can be an easy method to secure your liked ones. Yet as life adjustments your financial priorities can as well, so you may wish to have entire life insurance policy for its life time protection and additional advantages that you can make use of while you're living. That's where a term conversion is available in.

The Essentials: What is Term Life Insurance With Level Premiums?

Approval is ensured despite your wellness. The costs won't enhance once they're set, but they will certainly rise with age, so it's a good concept to secure them in early. Find out a lot more about exactly how a term conversion functions.

The word "level" in the expression "degree term insurance coverage" indicates that this sort of insurance coverage has a set premium and face amount (fatality advantage) throughout the life of the plan. Simply placed, when people speak about term life insurance coverage, they typically refer to level term life insurance policy. For the bulk of people, it is the most basic and most affordable choice of all life insurance coverage kinds.

What is Decreasing Term Life Insurance? Pros, Cons, and Considerations?

Words "term" here describes a provided number of years during which the level term life insurance stays active. Level term life insurance is among the most prominent life insurance policy policies that life insurance coverage carriers offer to their customers because of its simpleness and affordability. It is likewise simple to contrast degree term life insurance policy quotes and get the very best costs.

The device is as follows: Firstly, choose a plan, death benefit quantity and policy period (or term length). Secondly, pick to pay on either a monthly or yearly basis. If your early demise takes place within the life of the plan, your life insurance company will pay a swelling sum of survivor benefit to your predetermined recipients.

What is Term Life Insurance With Accidental Death Benefit and Why Is It Important?

Your level term life insurance coverage plan ends when you come to the end of your policy's term. Option B: Purchase a brand-new level term life insurance policy.

2 Expense of insurance coverage prices are identified using methodologies that vary by firm. It's important to look at all elements when assessing the overall competition of rates and the worth of life insurance policy protection.

Table of Contents

- – How Does Annual Renewable Term Life Insurance ...

- – Is Level Term Life Insurance Meaning Right for...

- – Short Term Life Insurance Explained

- – What is Life Insurance Level Term? Pros and C...

- – The Essentials: What is Term Life Insurance ...

- – What is Decreasing Term Life Insurance? Pros...

- – What is Term Life Insurance With Accidental ...

Latest Posts

Cheap Burial Insurance

Funeral Cover Companies

Burial Insurance Direct

More

Latest Posts

Cheap Burial Insurance

Funeral Cover Companies

Burial Insurance Direct